The example in this post is of the Health Rosetta template being completed for one of the components -- a Transparent Medical Network. Since it solves the most vexing problem in healthcare (pricing failure), we encourage you to share it with your benefits director, CEO, CFO or benefits consultant to get them to evaluate whether there is enough information to take action. This employer showed how it can contribute to spending 30% less per employee while providing a great health benefit.

If the Health Rosetta concept is new, I'd invite you to read the introduction to the concept and rationale as well as the comparison between the status quo and the Health Rosetta. See also Value-based Primary Care, Transparent Pharmacy Benefits, Concierge Style Employee Customer Service and ERISA plan checklist as examples of other sections of the Health Rosetta. The healthcare industry uses a variety of tricks to redistribute money from employers and taxpayers into their coffers. Highly effective benefits leaders use the Health Rosetta as the antidote to the plague of an under-performing healthcare system. Health Rosetta certifications will be market-driven and are loosely analogous to LEED and Fair Trade (click links for how the analogies are applied to healthcare) to accelerate the movement to a higher-performing system. The following is a blurb from that piece:

Just as the next generation of technology companies required a new technology stack, the health ecosystem needs a new health plan stack. New incentives and payment structures for providers, along with better access to information with new consumer technologies, and an array of new technologies are enabling the shift. Various pay-for-value incentives are driving us to look for ways to optimize health and prevent illness. A key component of the emerging, more democratic, landscape is a commitment to openness, feedback and learning. To rapidly innovate, we need open source and open innovation to drive our a learning health system.

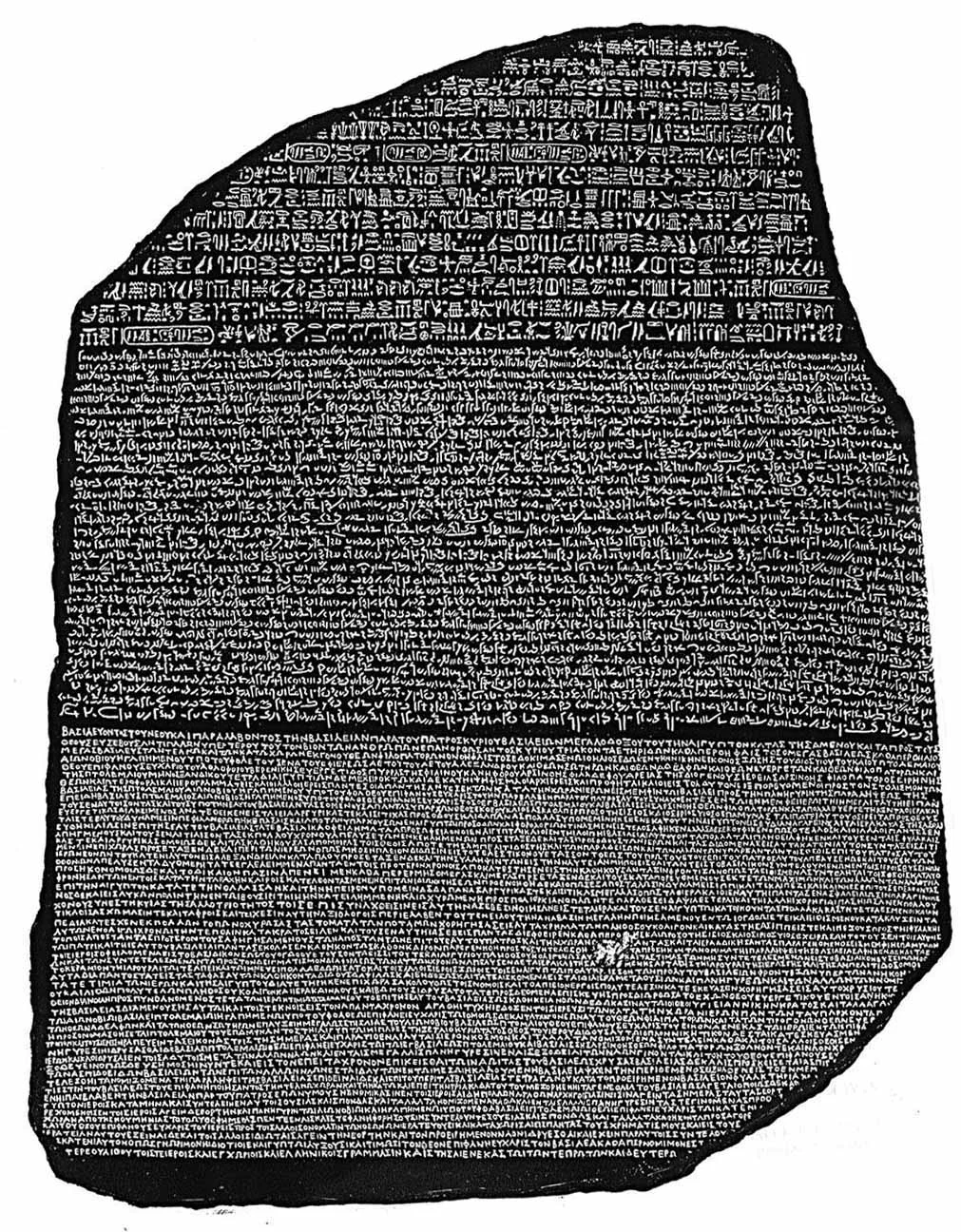

The text below is an example of a completed template for the Transparent Medical Market section. The graphic below shows how adding more and more layers of administration and bureaucracy has cost us dearly. As has happened in countless other sectors, there is an opportunity to use technology to gain efficiency.

Getting Started

What is a Transparent Medical Market

A Transparent Medical Market offers employers and organizations such as unions a set of fair and fully transparent pricing for medical services/procedures ranging from a specific treatment (i.e., knee replacement) to a specific condition (i.e. diabetes). Providers provide up-front pricing at significantly reduced rates in exchange for increased patient volumes, quick pay, reduced friction and the avoidance of claims/collections problems – all factors that allow for providers to have greatly reduced prices while netting a similar amount to standard insurance billing. Services and procedures are typically bundled, meaning there is just one bill for the all the services rendered across a specific treatment or condition, multiple providers and sometimes multiple settings. Another dimension of transparency is that the market is open to any provider who has sufficiently high quality indicators and is priced fairly.

It offers employers an alternative to traditional fee-for-service payment models which reimburse providers on volume alone where services are paid off itemized billing statements. Fee-for-service allows for wildly variant pricing, free from market forces and can incentivize providers to offer unnecessary services because reimbursement is based solely on the quantity of care.

How Does It Work?

Providers (typically imaging centers, specialty hospitals and ambulatory surgery centers) contract directly with an employer or third party to offer services outside of a typical payment and network structure. In exchange for significantly reduced rates employers incentivize plan members to utilize these providers by typically waiving all of the patient’s costs including copays, coinsurance and deductibles.

Why Should You Support It?

It is alternate payment and delivery system that benefits providers, employers and employees. Providers get access to patients whose employers offer quick pay, reduced hassles, no patient receivables concerns and predictable reimbursement without collections concerns. Employers get access to bundled, transparent rates at prices typically 50%-60% less than typical network prices (and even greater off of Chargemaster prices). Employees get access to a new benefit that offers medical services and procedures without financial penalties in the form of copays and deductibles. So providers get easy patients, employers get great prices and employees get the care they need for free.

The Diagnostic Toolbox

Key Elements

1) Transparency: It’s not possible for employers to measure the value of their healthcare dollar without access to pricing and quality information. The same information is needed by employees if they are expected to seek high value care. At a very minimum all medical services and procedures should offer an up-front, fair and honest price – i.e., making healthcare services as straightforward as other products and services we buy in our lives outside of healthcare. When available, quality information should also be readily available for employers and employees alike.

2) Bundled Payment: Traditional fee-for-services models reimburse providers based on the quantity of services and can encourage over-utilization. Bundled payment for a specific treatment or condition allows employers to reimburse providers for all the services needed across the entire treatment or condition. In specific treatments there is just one bill for the hospital, surgeon, anesthesia etc. For treatment across a specific condition there is just one bill for physician visits, diagnostics and care management.

3) Shared Risk: Fee for service payments can encourage overutilization and provide reimbursement based on quantity alone. Shared risk models encourage providers to account for the cost of services provided and the outcomes associated with services rendered either for a specific treatment or condition. Shared risk is most commonly addressed through a structure of global periods. Medicare has long required providers to share risk under 3 different global periods; Zero Day Post-operative Care, 10-day Post-operative period and 90-Day Post-operative period. Medicare isn’t going to pay for mistakes, complications and re-admissions – a transparent medical market brings that practice to the private sector.

4) Efficient Administration: In order for a Transparent Medical Market to lower employer costs and reduce overhead costs at the provider level, employers will have to consider restructuring the administration used behind it. Typical claims administration is filled with inefficiencies; slow payment cycles, prior authorization, network requirements, complicated payment models, employee cost sharing, etc… Employers must make it easy for employees to access care, offer quick pay (typically 5 days or less) to providers, eliminate barriers such as copays and deductibles and often remove oversight requirements like prior authorization. It’s important to remember the goal of this model is to simultaneously lower employer cost, eliminate the hassles and costs for providers while providing a true benefit to employees and members.

5) Employee Education: Models that encourage the use of specific providers for specific treatments are a new idea for employees and their families. It is also important that such models not be misconstrued as HMO models which were often associated with denied care, long wait times and poor customer service. The message needs to be simple, clear and intriguing. If you can’t explain it in one sentence you need to work on the message. Here is just one example: Don’t forget, if and when you need medical care we have a group of providers you can go see that won’t cost you anything.

6) Ease of Use: Health care has always been confusing, frustrating and very often scary. When employees need access to care it needs to be effortless. Consider offering concierge style advocacy that gives your employees access to the humans and resources they need. Such services can range from and often include appointment scheduling, medical records transfer and both web and mobile access.

Ensuring Quality:

A high quality Transparent Medical Market functions best in tandem with a proper primary care model such as Direct Primary Care and uses Shared Decision Making tools to avoid overtreatment and unnecessary radiation exposure from scans. Any high quality provider should be participating in all applicable quality reporting whether they are a health system, ambulatory surgery center or imaging center. Listed below are resources that can help ensure that the providers in the Transparent Medical Market are of the highest quality.

- HealthInsight is a private, non-profit, community-based organization dedicated to improving health and health care. They offer a free ranking tool for hospitals nationwide.

- The National Quality Forum (NQF) is a not-for-profit, nonpartisan, membership-based organization that works to catalyze improvements in healthcare. They offer access to a huge library of endorses quality measures.

- Hospital Compare has information about the quality of care at over 4,000 Medicare-certified hospitals- across the country. You can use Hospital Compare to find hospitals and compare the quality of their care.

- The Leapfrog Hospital Survey is the gold standard for comparing hospitals’ performance on the national standards of safety, quality, and efficiency that are most relevant to consumers and purchasers of care. The survey is the only nationally standardized and endorsed set of measures that captures hospital performance in patient safety, quality and resource utilization.

Challenges To Expect

- Administrative Challenges: Your broker, consultant, carrier or TPA may be unable or unwilling to provide transparent specialty care and the administration needed to execute such a program.

- Provider Reluctance: It won’t be uncommon for large incumbent health systems to push back on requests for price and quality and transparency.

- Lengthy Implementation: The process can be quite cumbersome and drawn out should you decide to go it alone. You might consider utilizing a third party to help streamline the process.

- Employee Education: Such models will require continued messaging and clear, easy to understand action steps.

- Data Sharing: It could be difficult to obtain pricing and quality information from your current broker, consultant, carrier or TPA. Since it is your spending, you have a right to this information.

- Data Analytics: Traditional claims analysis software programs and services are often limited in scope and not designed to provide clarity or actionable insight.

- Confusion with Price Transparency tools: Price transparency tools (e.g., Castlight) provide information on insurance PPO network pricing but they don’t remove the hassles and costs for both providers and individuals related to claims, co-pays, etc.

- Incumbent Obfuscation to Preserve Status Quo: Incumbents who aren’t forward-looking are likely to use common “Fear, Uncertainty & Doubt” tactics meant to freeze progress. As stewards of your organizations’ and employees’ hard-earned money, one must choose whether they care to protect their own bottom-line or that of their supplier.

Action Steps

- ASK you broker, consultant, carrier or TPA if they participate in any transparency initiatives

- ENCOURAGE your broker, consultant, carrier or TPA to make both cost and quality data available to both you and your employees

- CONSIDER modifying your benefits plan to provide incentives for employees and their families to access care from transparent providers

- VISIT a local hospital or surgery center to begin a discussion or consider tapping a 3rd party Transparent Medical Market service provider who may already service your area or can expand to serve your employees.

Shared Resources

Catalyst for Payment Reform (CPR) is an independent, nonprofit corporation working on behalf of large employers and other health care purchasers to catalyze improvements in how we pay for health services and promote higher-value care in the U.S.

http://www.catalyzepaymentreform.org/

FAIR Health is a national independent, not-for-profit corporation whose mission is to bring transparency to healthcare costs and health insurance through comprehensive data and consumer resources.

http://fairhealthconsumer.org/

The Surgery Center of Oklahoma is multi-specialty surgical facility widely credited as the first provider group to wholly embrace transparent specialty care. Even before Transparent Medical Markets are available in your area, organizations and individuals are using the transparent prices to negotiate sub PPO Network prices.

http://www.surgerycenterok.com/

Case Studies

Health Care Price Transparency: Can It Promote High-Value Care?

http://www.commonwealthfund.org/publications/newsletters/quality-matters/2012/april-may/in-focus

Open Questions

- Would it be helpful to list vendors offering the service?

- Do you have other forms or requirements that would need to be addressed?

- What are we missing?

- Are there tools we should use to manage/update the various Health Rosetta components (currently, it's collaboratively edited in Google Docs).

Acknowledgements and Disclosures: The initial draft of this was completed byJim Millaway, Benefits Consultant for HUB International and founder of The Zero Card.

Subscribe to The Future Health Ecosystem Today or follow on Twitter

Contact via Healthfundr for expertise requests or speaking engagements

Upcoming travel/speaking schedule present opportunities to get on Dave's speaking calendar:

- Week of March 21: New York City

- Week of March 28: Washington DC

- Week of April 4: Montreal, Toronto, Chicago

- Week of April 25: Orlando

- Week of July 25: Montana

- Week of September 19: Northern Europe