Earlier I wrote about how benefits advisors could save America. At the same time, I was stunned that a tech entrepreneur/investor who does writing on the side (me) was finding proven solutions to slay the healthcare cost beast that most benefits brokers didn’t know about. A conversation I had with one of the country’s leading consultants to benefits organizations explained the disconnect.

The key word is “broker”. He said those who are/were in the dark are just like old-line stock brokers — they primarily care about the transaction happening not whether their client is getting the absolute best return. The following is his stinging commentary:

Employees should be outraged and plan sponsors should feel like Madoff has been managing their money — it is time for change and the incumbents are just not getting the job done.

Since some of these organizations are his clients, it was understandable that he asked that he not be quoted. It made me think that the fact that traditional stock brokers have gone the way of the dodo bird, there would be some lessons learned. Many stock brokers have evolved into financial/wealth advisors in order to maintain their relevance. Forbes contributor, Andre Cappon, examined the evolution of brokerages.

As has taken place with stock brokers, there is a near total overhaul of benefits brokers such as Aon Hewitt, Mercer & Towers Watson that is underway. For example, the fact that Health Affairs has reported that workplace wellness programs have produced no savings and there is a $1 million reward to show wellness works makes it pretty hard to justify what many old-line brokers are peddling. While there are other reasons beyond pure finances to have a workplace program, most programs tout outlandish ROIs defying the laws of math. This is a key reason that benefits consultancies, third-party administrators and business coalitions are re-orienting their annual conferences and customer events to revolutionize their constituents’ health benefits purchasing. It’s been inspiring to speak with the leaders of these organizations eager to dramatically overhaul the status quo.

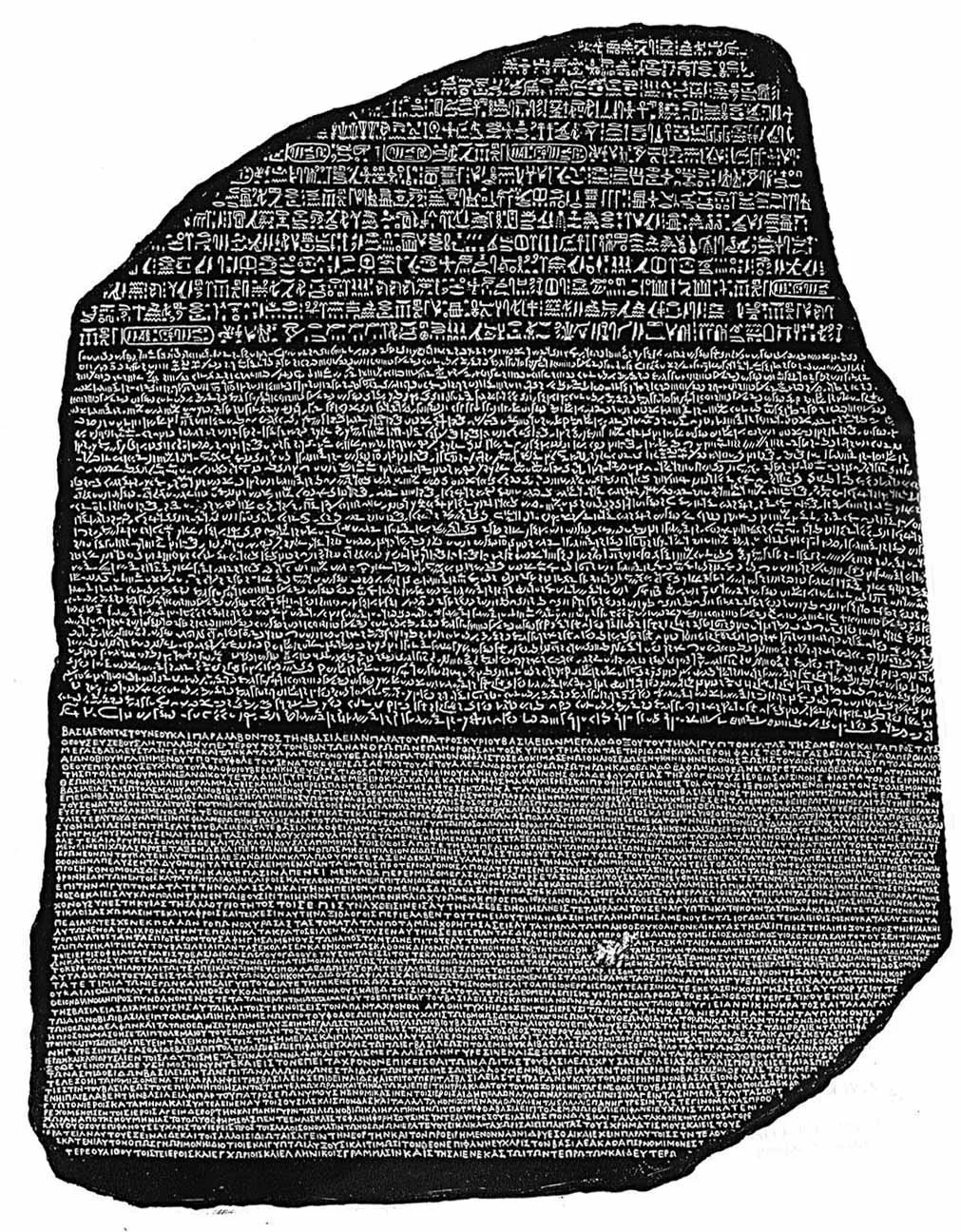

In contrast, the most innovative benefits advisors are just like extraordinary money managers and wealth advisors — they’re worth their weight in gold as they apply the Health Rosetta blueprint. For example, I’ve written about how one has helped solve healthcare’s most vexing problem — pricing failure. Another has paradoxically proven that the best way to slash healthcare costs is to improve health benefits.

[Disclosure: As I've disclosed many times, the Health Rosetta is a non-commercial open-source project that provides a reference model for how purchasers of healthcare should procure health services. In my role as managing partner of Healthfundr, a seed stage venture fund, the Health Rosetta is the foundation of our investment thesis.]

Naturally, modern benefits advisors need technology solutions. If you look at the 7 organizations that will turn healthcare upside down in 2016, there are a couple of organizations mentioned that fall into this category.

- Collective Health enables self-insured employers. They recognize that any company over 100 employees is an “insurance company” in all but name. Only the laggards aren’t becoming self-insured. Collective Health brings transparency and ease-of-use where it hasn’t existed before. They also beg the question, “what can’t be done better by an algorithm than by an insurance company?” We know that health insurers haven’t slayed the healthcare cost beast, improved health outcomes or made doctors lives better while simultaneously having the lowest Net Promoter Score of any industry. This is why the smart health plans are aggressively pursuing new areas of business and/or they are setting up skunkworks businesses to reinvent their offerings that are having early success.

- Maxwell Health has long been a favorite of mine despite Zenefits getting most of the press (though not so great press lately). I viewed Zenefits primarily as paving the cow path — i.e., doing nothing to change the fundamentally terrible status quo of health benefits. In contrast, Maxwell’s leadership understood that healthcare’s hyperinflation has been devastating retirement nest eggs. This is why the smartly partnered with MassMutual (a retirement plan provider).

Forward-looking benefits advisors recognize that millennials have fundamentally different requirements than their boomer parents. As that article outlined, millennials are the largest chunk of the workforce with companies such as Ernst & Young having 60% of their workforce being millennials. Millennials also aren’t afraid to question the status quo and go after large, entrenched organizations. They see that there has been a catastrophic misalignment of resources in healthcare that will cost their generation dearly. It shouldn’t have come as a surprise that millennials were the first backers of the documentary that seeks to be the Super Size Me/An Inconvenient Truth for healthcare (expected in 2017).

Wise benefits advisors are seeing a growing risk for their clients and are advising these employers to corral the risk they are increasingly exposed to in two areas :

- With companies spending 50% less on health benefits with outstanding benefits and healthcare being the second largest expense for most companies after wages, squandering money unnecessarily suggests that CEOs and CFOs are failing in their fiduciary responsibility. One Fortune 500 company that I know of achieved a 1.8% higher EBITA in their last earnings report as they had successfully moved a substantial chunk of their employees with cardio-metabolic issues into a program that has achieved great outcomes. Paradoxically, employers are demonstrating that the best way to slash healthcare costs is to improve health benefits.

- Not unlike 401-k’s, ERISA plans come with fiduciary responsibilities. However, unlike 401-k plans, most companies have a much less rigorous oversight regime for their ERISA health plans though just as much money is at stake as a 401-k plan. ERISA lawyers I’ve spoken with expect that the high deductible plans that are becoming de rigueur will get the attention of employees responsible for a greater portion of their medical bills. The example one lawyer gave was how an employee can rightfully question an outrageous charge for a simple item like a $500 tooth brush or $20 gauze pad as they understand it and will recognize it is the tip of the iceberg on outrageous charges that employers aren’t policing properly. Since healthcare’s most vexing problem (pricing failure) has been solved with the help of a small manufacturer and the largest non-profit health system in the country has moved to true transparent prices, employers no longer have a valid excuse to accept healthcare’s hyperinflation when it is readily tackled if an organization takes its fiduciary responsibility seriously.

As technology startups automate the commodity side of a benefits brokers’ job, forward-looking benefits professionals realize they must step up their game or they’ll get left behind. Over the last 18 months, Leonard Kish and I curated the leading thinkers inhealthcare’s enlightenment. These were captured in the 95 Theses for a New Health Ecosystem. A subset of those guiding principles were highlighted in Benefits Consultants 11 Rules for Success in the Future Health Ecosystem.

This article was also published in Forbes

Subscribe to The Future Health Ecosystem Today or follow on Twitter

Contact via Healthfundr for expertise requests or speaking engagements

Upcoming travel/speaking schedule present opportunities to get on Dave's speaking calendar:

- Week of March 28: Washington DC

- Week of April 4: Montreal, Chicago

- Week of April 25: Orlando

- Week of June 13: New York City

- Week of July 4: Toronto

- Week of July 25: Montana

- Week of September 19: Northern Europe